The Problem

The global ecosystem of private capital remains highly fragmented, preventing the efficient flow of capital toward high-impact solutions.

Fragmented Stakeholders

Private capital, impact investors, venture philanthropy, and institutional investors operate in isolation.

Misaligned Incentives

Despite shared goals, stakeholders face regulatory complexities and lack structured collaboration frameworks.

Underutilized Capital

Impact-driven ventures struggle to secure funding, opportunities for systemic change are missed, and capital remains underutilized.

Bridging these gaps is essential to unlocking the full potential of investment and innovation for a more sustainable and inclusive global economy.

Our Mission

« Optimizing economic efficiency by reducing transaction costs and accelerating cross-border deal flows »

Our Five Strategic Pillars

Governments and Chambers of Commerce

Banks and Financial Institutions

Corporate Institutions, SMEs

Philanthropy and Royalty

Startups and Youth

Watch: The Future of Switzerland Leadership, Policy, and Innovation

Our Product Suites

Comprehensive solutions designed to maximize your investment potential

IFED Private Bank

The first AI driven underwriter Bank in Switzerland - Merging Tradition with the Future

IFED Foundation

Bridging the Death Valley gap with new de-risking initiatives

IFED Holding

Cross-Border political collaboration with Governments and Chambers of Commerces

Smart Contract Vault

Secure blockchain solutions for contracts and commission agreements

Real Estate Syndication

International Real Estate, Event and Syndication opportunities

Startup Incubator

Nurturing innovative businesses from concept to market

Wealth Advisory

Personalized financial guidance and succession solutions

Private Equity Access

Exclusive investment opportunities in private markets

Wellness and Health

Holistic well-being services for our community

CRM Lead Suite

Advanced client relationship management tools

Event Strategy Hub

Strategical Hub to plan and organize professional events

Equity and IP Trading

Strategic trading of equity positions and intellectual property assets

Why Invest in IFED

A strategic investment with proven track record, innovative approach, and exceptional growth potential.

Proven Track Record

Consistent growth and performance metrics that demonstrate our ability to deliver results.

Risk Management

Strategic approach to mitigating risks while maximizing potential returns on investment.

Market Leadership

Positioned at the forefront of industry innovation with significant competitive advantages.

Our Founder

Visionary leadership driving global economic development and innovation

Professional Background

Serves as the President of the International Federation for Economic Development (www.IFED.Global), a leading global institution dedicated to advancing sustainable economic growth and fostering entrepreneurial ecosystems worldwide.

Partners with national governments, multilateral organizations, and private sector leaders to drive strategic investments and catalyze transformative economic development across diverse regions.

Distinguished figure in Swiss politics, serving as a National Delegate for the Green Party Switzerland, contributing to critical voting decisions on progressive initiatives focused on sustainability, innovation, and inclusivity.

2023 candidate for the Swiss National Council, earning the Avanti Verdi Nr. 1 title and the Parldigi Champion title for her work in digital sustainability and governance.

Recognized as a Global Shaper under the auspices of the World Economic Forum, part of a global network of leaders driving initiatives for positive change.

Expert in artificial intelligence and blockchain with pioneering work to establish Switzerland's first underwriter bank focused on start-up development and fractionalized property syndication.

Award-Winning Filmmaker

- World premiere in Hollywood

- 13 international awards

- Student Visionary Award at Robert De Niro's Film Festival

Political Recognition

- National Council Elections Avanti Verdi Nr. 1

- Award-winning ParlDigi Champion

- National Delegate for Green Party Switzerland

Education & Expertise

- Bachelor of Science in Business Administration

- Major in Digital Business and AI Management

- KBZ Advisor in Finance and Accounting

Organizational Structure

A robust framework of expertise across our key business entities

Executive Leadership

Antonia Martina Durisch

President

Overseeing all IFED organizations

Antonela Jovanovic

Group Chief of Staff

Monitoring all IFED entities

IFED Holding

Dr. Nazar al Baharna

Chairman

Dr. Catherine Blum

CIO Holding

Ahsan Ahmed

Chartered Accountant

IFED Private Bank

Anish Wig

CEO

Francesco de Simone

CIO Bank

Oliver Heiler

CRO

Animesh Ghosh

CTO

Gouzel Moussina

COO

Mariya Spartalis

CMO

Riccarda Cavelti

Head of Real Estate Investments

Abdul Salam Beary

Senior Relationship Manager

IFED Foundation

Antonia Martina Durisch

CEO

Anahita Valia Bam

COO

Philipp Drebes

CTO

Our Approach

Creating a unified ecosystem for sustainable global economic development

IFED is architecting a comprehensive integrated ecosystem that synergizes governmental frameworks, institutional capital, SME innovation, entrepreneurial ventures, and philanthropic initiatives within a unified infrastructure, delivering quantitative analytics and AI-enhanced decision intelligence for optimal capital allocation.

Our strategic methodology encompasses systematic risk mitigation through sovereign partnerships and regulatory alignment, subsequently deploying our extensive global networks to establish bespoke venture capital instruments for SMEs and structured institutional investment vehicles targeting emerging market opportunities and frontier technologies with asymmetric return profiles.

Aligned with UN Sustainable Development Goals

Our approach is fully aligned with the United Nations Sustainable Development Goals, creating economic opportunities while addressing global challenges.

Our Innovation

Pioneering transformative solutions for the global financial ecosystem

Holistic Economic Framework

We have architected a comprehensive economic and financial paradigm that transcends traditional models, effectively bridging the precarious "death valley" period for emerging ventures. Our framework not only provides capital but delivers sophisticated educational resources and leverages cutting-edge technology to facilitate unprecedented global connectivity between innovators and capital allocators.

Data-Driven Investment Protocol

We have fundamentally reimagined venture capital deployment methodologies by integrating a sophisticated SME venture builder arm into our operational model. By implementing real-time key performance indicator measurement systems, we enable investment decisions predicated on quantifiable metrics and empirical data rather than subjective presentations, thereby optimizing capital allocation efficiency and enhancing return predictability.

Decentralized Governance Architecture

Through the implementation of a Decentralized Autonomous Organization (DAO) architecture within our foundation, we systematically mitigate nepotism, corruption, and bias risks inherent in traditional funding models. This structure establishes a meritocratic, community-driven decision-making apparatus for capital distribution, ensuring resources flow to ventures with demonstrable potential rather than those with privileged connections.

Blockchain-Secured Transactions

By harnessing the immutable and transparent properties of distributed ledger technology, we facilitate secure, frictionless business transactions with unprecedented integrity. Our blockchain implementation reduces counterparty risk, eliminates intermediary inefficiencies, and provides cryptographic verification of all transactional activities, creating a foundation of trust essential for cross-border financial operations.

Integrated Ecosystem Acceleration

Our meticulously engineered ecosystem and streamlined pipeline represent the first truly holistic framework capable of catalyzing high-velocity international collaborations and investments. By eliminating traditional barriers between stakeholders and implementing intelligent process automation, we compress transaction timelines from months to days, creating unprecedented operational efficiency in global capital deployment and business development initiatives.

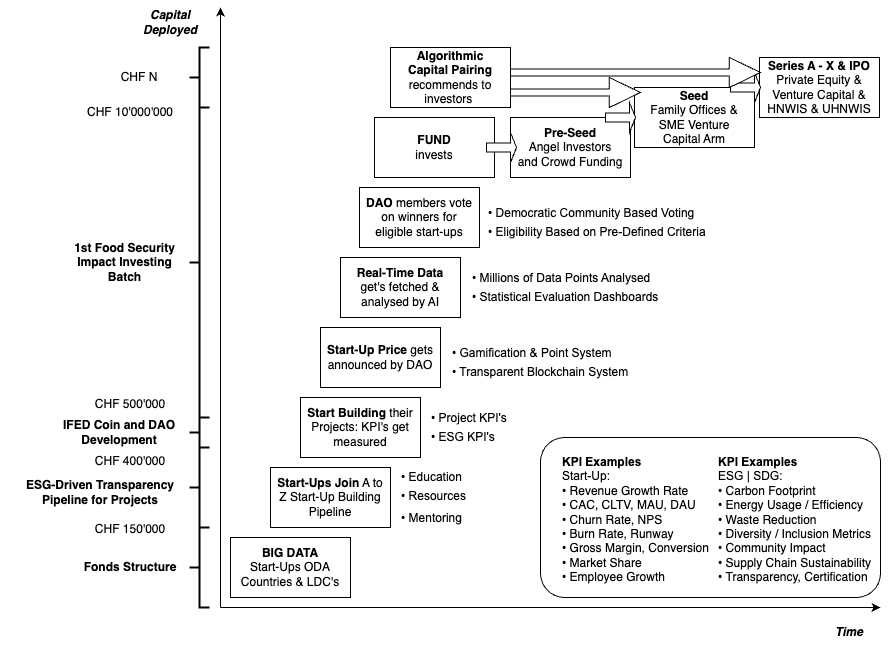

Our Investment Mechanism Framework

The Six Pillars of Our Revolutionary Financial Mechanism

Start-Ups

innovation

DAO Foundation

governance

Institutional Investors

investments

Bank Ecosystem

platform

Startup Incubator

education

Artificial Intelligence

technology

Our comprehensive capital deployment framework illustrates the systematic approach to funding allocation, from initial assessment through algorithmic pairing to scaled investment.

Strategic Roadmap

Our expansion strategy and key milestones for the coming years

2025

Global Technological Ecosystem

Finalizing the comprehensive global technological ecosystem outlined in our product suites, creating a seamless integration platform for all stakeholders.

Collaborating with SIFI to establish the first De-Risking Fund, which will serve as a testing ground for our innovative AI-driven financial mechanisms. We are currently awaiting feedback on our application, with only 3 projects expected to be selected from over 300 submitted proposals.

2025

SIFI De-Risking Fund

January 2026

Property Syndication Platform

Completing our Property Syndication platform to onboard the first Event Apartments during the World Economic Forum, creating a showcase for our innovative real estate investment model.

Attending key strategic forums including the European Brand Institute's forum in Austria, Zukunftstag-Mittelstand (Future Day for SMEs) of the Federal Association of Small and Medium-Sized Enterprises, Business Day of the Economic Council of the CDU, an Economic Forum in Brazil, and participating as speakers on events hosted during the World Economic Forum.

2025-2026

Strategic Marketing and Networking

2025

First Investment Contracts

Finalizing our first investment contracts after a two-year period of self-funding, marking a significant milestone in our growth trajectory.

Launching an IFED-driven podcast series focusing on industry best practices, market transformations, and emerging trends in global finance and economic development.

2025

Finance Podcast Series

2026

SME Venture Capital Arm

With our system fully operational, we'll have the capacity to onboard approximately 1.2 million SMEs into our venture capital arm section across Europe, creating unprecedented access to capital for growing businesses.

Assembling a consortium of suitable investors for our planned bank acquisition, scheduled for 2026-2027, with a calculated three-year transition period to complete the takeover process.

2026-2027

Bank Acquisition

Strategic Partners

Collaborating with world-class organizations to drive innovation and growth

European Brand Association

Partnering to establish and maintain the highest standards in brand development and protection across European markets.

UNIDO

Collaborating with the United Nations Industrial Development Organization to promote sustainable industrial development globally. We are actively working on establishing a dedicated fund with UNIDO to accelerate sustainable development initiatives across emerging markets.

Bundeswirtschaftssenat Deutschland

We have been invited to present our organization to Germany's Federal Economic Senate and are actively seeking a strategic alliance to foster economic growth and international business relations. This prestigious opportunity will enable us to expand our network within one of Europe's most influential economic bodies.

Global Excellence in Leadership Summit

We have been nominated for the Excellence Awards at this prestigious event taking place at the UK Parliament, Westminster, London on October 10, 2025. We will attend to deepen our relations with India and engage with international business delegations, fostering new strategic partnerships in the South Asian market.

Key Strategic Partners

Industry leaders who share our vision and contribute to our success

Samih Sawiris

Samih Sawiris is a billionaire Egyptian entrepreneur and one of the most successful businessmen in the Middle East. As the founder of Orascom Development Holding, he revolutionized real estate and tourism, developing world-class resorts and integrated communities in Egypt, Montenegro, and Switzerland. His ventures have expanded into various sectors, including hospitality, construction, and infrastructure, solidifying his status as a key figure in global development. In addition to his business success, Sawiris is dedicated to social impact, co-founding the Sawiris Foundation for Social Development in 2001, which focuses on job creation and community empowerment in Egypt. His strategic vision and extensive network make him an invaluable partner in our global expansion initiatives.

Dr. Dieter Falke

Dr. Dieter Falke, an heir to the renowned Falke family—esteemed for their premium textile enterprise established in 1895—has carved a distinguished path in the financial sector. Transitioning from his family's legacy in high-quality apparel, Dr. Falke ventured into banking, where he held significant positions, including serving on the management board of WestLB, a prominent German bank. Demonstrating entrepreneurial acumen, he founded his own institution, the Falke Bank, in February 2000. This venture aimed to provide comprehensive financial services to medium-sized enterprises, reflecting his commitment to supporting the Mittelstand segment of the economy. Currently, Dr. Falke is the Managing Director of Quant.Capital Management GmbH, an independent asset management firm based in Düsseldorf, managing assets totaling €2.1 billion.

Dr. Nazar Al Baharna

Dr. Nazar Al Baharna is a seasoned politician and entrepreneur who played a key role in Bahrain's political landscape as a founding member of the Al Wefaq National Islamic Society. In 2005, he became Deputy Chairman of the Bahrain Chamber of Commerce and Industry, strengthening his influence in both business and governance. Appointed Minister of State for Foreign Affairs in 2006, he served until 2011, navigating Bahrain's international relations during a critical period. He is widely recognized for his significant contributions to human rights advancement in Bahrain and his pioneering work in establishing the Tamkeen fund, which has been instrumental in supporting economic development initiatives. As a seasoned ESG and SDG expert, Dr. Al Baharna continues to advocate for sustainable development practices globally while leading Technology Consulting Group and serving as an advisory board member of the Iman Foundation.

Investment Packages

Choose the investment tier that aligns with your goals and risk tolerance.

- 5% of the Holding

- 5% of the Foundation

- No IP rights of tech suite

- No brand rights

- No voting rights

Capital Allocation Strategy

- • Establishment of corporate infrastructure and legal entities across strategic jurisdictions

- • Implementation and capitalization of the de-risking fund with regulatory compliance

- • Procurement of ISIN designation for financial instrument recognition and tradability

- • Finalization of proprietary technology stack and intellectual property securitization

- • Development and execution of comprehensive digital marketing strategy with analytics integration

- • Organization of inaugural investment symposium in collaboration with seasoned political and VIP event veterans

- 10% of the Holding

- 10% of the Foundation

- Right of first refusal for bank acquisition

- Restricted voting rights

- No IP rights of tech suite

- No brand rights

Capital Allocation Strategy

- • Full implementation of foundational infrastructure established in the $1M allocation

- • Strategic market penetration through multi-channel global acquisition campaigns

- • Systematic onboarding of 1.2 million SMEs and Global Shapers into the ecosystem

- • Implementation of startup acceleration program and next-generation leadership initiatives

- • Acquisition of ISO certification frameworks and Basel IV regulatory compliance protocols

- • Strategic procurement of institutional investor and family office relationship databases

- • Representation at tier-one global financial forums and economic symposiums

- • Establishment of permanent presence at the World Economic Forum annual meeting

- • Recruitment and retention of executive talent and specialized implementation teams

- • Acceleration of data-flywheel adoption to enhance AI-driven financial modeling capabilities

Financial Registry

Comprehensive financial analysis demonstrating the exceptional value of your investment

IFED Private Bank - Discounted Cash Flow Analysis

BASE Case Scenario with slow growth

Operating Model

| Projected | |||||

|---|---|---|---|---|---|

| 2026 | 2027 | 2028 | 2029 | 2030 | |

| Income Statement | |||||

| Revenue | 834'244 | 3'231'131 | 6'900'749 | 16'495'966 | 33'138'838 |

| Total Revenue | 834'244 | 3'231'131 | 6'900'749 | 16'495'966 | 33'138'838 |

| COGS | 144'523 | 561'924 | 831'878 | 884'471 | 1'543'197 |

| Gross Profit | 689'722 | 2'669'207 | 6'068'872 | 15'611'495 | 31'595'641 |

| Operating and other income expenses | 8'399'230 | 9'987'644 | 10'401'794 | 13'147'355 | 15'842'102 |

| Operating Profit (EBIT) | -7'709'509 | -7'318'436 | -4'332'922 | 2'464'140 | 15'753'539 |

| Margin | -924% | -226% | -63% | 15% | 48% |

| Supplemental Items: | |||||

| Capital Expenditures | -1'880'259 | 0 | 0 | 0 | 0 |

| Depreciation and Amortization | 1'880'259 | 1'880'259 | 1'880'259 | 1'880'259 | 1'880'259 |

| Stock-Based Compensation | 0 | 0 | 0 | 0 | 0 |

| Net Working Capital (NWC) | -871'610 | -6'310'148 | -8'763'171 | -4'419'132 | 197'708'556 |

| Change in NWC | -871'610 | -5'438'538 | -2'453'024 | 4'344'039 | 17'627'688 |

DCF Analysis

| 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|

| EBIT | -7'709'509 | -7'318'436 | -4'332'922 | 2'464'140 | 15'753'539 |

| Cash Taxes | -1'156'426 | -1'097'765 | -649'938 | 369'621 | 2'363'031 |

| NOPAT | -6'553'082 | -6'220'671 | -3'682'984 | 2'094'519 | 13'390'509 |

| Capital Expenditures | -1'880'259 | 0 | 0 | 0 | 0 |

| D and A | 1'880'259 | 1'880'259 | 1'880'259 | 1'880'259 | 1'880'259 |

| Stock-Based Compensation | 0 | 0 | 0 | 0 | 0 |

| Change in NWC | -871'610 | -5'438'538 | -2'453'024 | 4'344'039 | 17'627'688 |

| Unlevered Free Cash Flow | -7'424'693 | -9'778'950 | -4'255'749 | 8'318'817 | 32'898'455 |

Key Metrics

Investment Highlights

- Exceptional ROI of 366% over a 5-year investment horizon

- Strong positive cash flows beginning in Year 4 (2029)

- Projected 48% profit margin by 2030, demonstrating operational efficiency

- Revenue growth from €834K to €33.1M over 5 years (3,870% increase)

Understanding Our Exceptional Returns

The extraordinary ROI (366%) and IRR (24%) projections are driven by IFED Bank's proprietary big-data-driven AI financial model, which creates sustainable competitive advantages through two key mechanisms:

Data Flywheel Effect

Our AI systems continuously improve as they process more financial transactions and client interactions. Each data point enhances predictive accuracy, risk assessment capabilities, and personalization, creating a self-reinforcing cycle where improved performance attracts more clients, generating more data, further improving our systems.

Network Effects

As our platform grows, the value delivered to each participant increases exponentially. Our ecosystem connects investors, SMEs, governments, and other stakeholders, creating powerful network effects where each new participant enhances the value proposition for all existing members, driving accelerated adoption and revenue growth.

Revenue Streams

Diverse and sustainable income sources powering our growth and investor returns

Subscription Model

Members are charged a nominal monthly fee to access the platform, while investors pay a premium subscription for enhanced features and opportunities.

Transaction Fees

Each investment transaction facilitated by our proprietary Algorithmic Capital Pairing Artificial Intelligence Recommender System generates a commission for the bank.

IPO Commissions

We earn a percentage from each Initial Public Offering (IPO) we facilitate, capitalizing on our platform's ability to guide businesses through to public listing.

Advertising

The platform leverages a sophisticated advertising model akin to those used by major social media networks like Facebook, Instagram, and TikTok, providing targeted advertising opportunities for both members and investors.

E-commerce Integration

We enhance commercial transactions through e-commerce capabilities, which allow seamless sales transactions within our community-driven platform.

Banking Services

Comprehensive banking solutions including deposits, credit cards, investment banking, wealth management, and more.

Banking Services Portfolio

Certificates of Deposit (CDs)

Fixed-term deposit accounts that offer higher interest rates in return for customers agreeing to leave a lump sum deposit untouched for a predetermined period.

Business Credit Cards

Credit cards issued to businesses to help manage company expenses and cash flow.

Investment Banking

Services that include underwriting, acting as intermediaries between securities issuers and the public, facilitating mergers and acquisitions, and providing financial advisory services to corporations.

Wealth Management

Comprehensive management of clients' financial affairs, including investment management, financial planning, estate planning, and more.

Trading and Sales

Buying and selling of securities such as stocks, bonds, and other financial instruments.

Asset Management

Managing investments on behalf of clients, including portfolio management and fund management.

Treasury Services

Services that help businesses manage their daily financial operations and liquidity, including cash management, issuing of checks, and electronic funds transfer.

Wire Transfers and Payment Services

Electronic transfer of funds across banks or transfer agencies.

Foreign Exchange and International Banking

Services related to currency exchange and international banking needs such as trade financing and letters of credit.

Web3 Financial Services

Innovative financial services leveraging blockchain technology, including digital asset management, cryptocurrency trading, and integration of decentralized finance (DeFi) platforms. This includes the use of smart contracts, decentralized autonomous organization (DAO) structures, and tokenization to enhance the security and efficiency of financial transactions.

Frequently Asked Questions

Comprehensive answers to common investor inquiries about our company and investment opportunity